Canadian Credit Karma members with student loan debt owe more than $17,000 on average, with total debt varying by region, city and age, according to a recent Credit Karma analysis.

Residents of the metro areas of Toronto and Vancouver face more than $20,000 in student loan debt on average — almost twice as much as those in Manitoba, the region with the lowest student loan debt among members, our analysis found. (Learn about our methodology.)

We also found that Canadian millennials in particular are impacted by student loan debt, which shows that, as in the U.S., the effects of student loans can linger long after graduation.

But even student loan debt balances in the tens of thousands can be manageable. We provide some tips below to help you manage your payments. But first, let’s take a look at what student loan debt looks like among members across the Great White North.

Want to know more?

- Key findings

- Areas with the highest and lowest average student loan debt

- Average student loan debt across generations

- Tips to manage student loan debt

Key findings

| On average, Canadian Credit Karma members who have student loans owe $17,741 in student loan debt. |

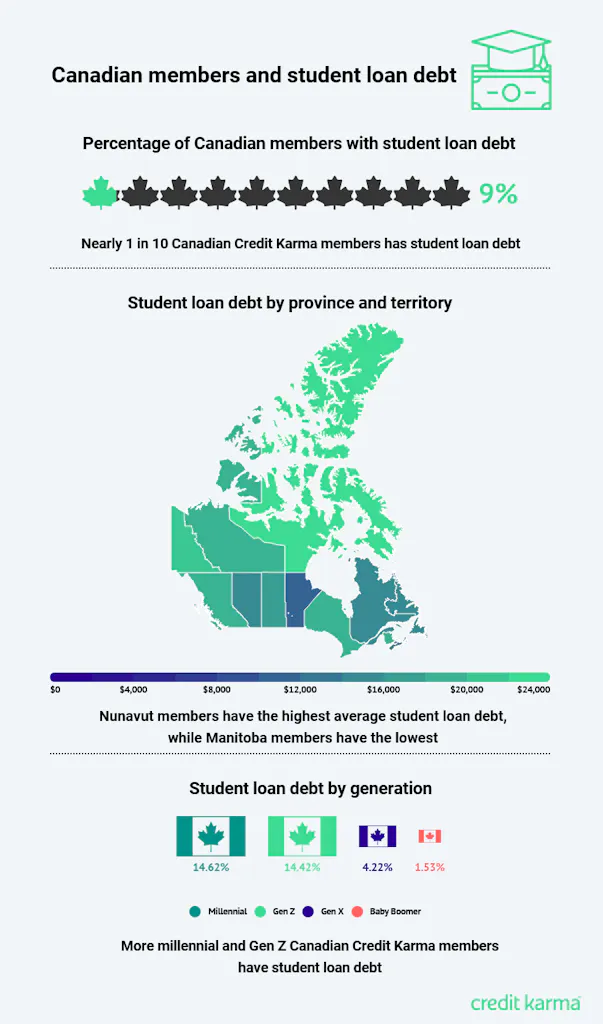

| Nearly 1 in 10 Canadian Credit Karma members (9%) has student loan debt. |

| Among Canadian Credit Karma members, average student loan debt is highest in Nunavut and lowest in Manitoba. |

| Toronto is the metropolitan area where Credit Karma members carry the highest average student loan debt. |

| More millennial Credit Karma members in Canada have student loan debt (14.62%) compared to other generations. |

Areas with the highest and lowest average student loan debt

Canadian Credit Karma members living in Nunavut carry the highest average student loan debt, at $25,644, according to our analysis. That’s almost $4,000 more than in Yukon, the region with the second-highest average student loan debt among members, and more than twice the average student loan debt as members in Manitoba, the region with the lowest average student loan debt.

|

Student loan debt by province/territory |

|

|

Province/Territory |

Average among members |

| Nunavut | $25,644 |

| Yukon | $21,823 |

| British Columbia | $19,722 |

| Ontario | $18,784 |

| New Brunswick | $18,736 |

| Northwest Territories | $18,649 |

| Saskatchewan | $17,542 |

| Newfoundland and Labrador | $15,989 |

| Quebec | $15,124 |

| Alberta | $14,472 |

| Prince Edward Island | $13,927 |

| Nova Scotia | $13,702 |

| Manitoba | $11,831 |

While it has the highest average student loan debt among Canadian Credit Karma members, there’s also some good news coming out of Nunavut. On average, Credit Karma members there have paid off more of their balances than any other region except the Northwest Territories.

When it comes to the largest metro areas in Canada — Toronto, Vancouver and Montreal — average student loan debt is higher or about the same as the average among all Canadian Credit Karma members carrying student loan debt. Among metro cities, Toronto has the highest average student loan debt among members, at $20,809, with Vancouver only about $300 behind. Compared to the average for all members in Quebec, Montreal’s student loan debt among members is about $2,000 higher than that of members in the rest of the province.

|

Student loan debt by major metropolitan area |

|

|

Metro |

Average among members |

| Toronto | $20,809 |

| Vancouver | $20,508 |

| Montreal | $17,463 |

Average student loan debt across generations

As we previously found in the U.S., more millennial Credit Karma members in Canada carry student loan debt (14.62%) than any other generation. And millennials also have the highest average student loan debt balances among Canadian Credit Karma members, at nearly $19,000.

Gen Z members have the least amount of student loan debt on average, at nearly $12,000. But Gen Z members are almost as likely as millennial members to have student loan debt (14.42%). And both millennials and Gen Z members are far more likely to have student loans than Gen X (4.22%) or Baby Boomer (1.53%) members.

|

Average student loan debt across generations of Canadian Credit Karma members |

||

|

Generation |

% with student loan debt |

Average student loan debt balance |

| Millennials | 14.62% | $18,986.40 |

| Gen Z | 14.42% | $11,940.40 |

| Gen X | 4.22% | $16,501.46 |

| Baby Boomers | 1.53% | $18,648.13 |

Tips to manage student loan debt

Student loan debt doesn’t have to drive you crazy. We’ve got some tips on how to manage your monthly payments below.

Know your repayment plan options

If your monthly student loan payment is more than you can afford, you may have options to renegotiate the terms or apply for a Repayment Assistance Plan. You can find out more about your repayment options at the National Student Loans Service Centre.

Extend your repayment term

Do your monthly payments feel like too much? You may be able to extend your repayment term, which could reduce your monthly payments. Keep in mind, though, that this usually means you’ll be paying more interest over the life of the loan.

If you have an online account with the NSLSC, you can use the Customize Payment Terms tool to see how different repayment amounts might impact your loan. Then, if you find an adjustment that fits your budget, you can request a Revision of Terms.

Give yourself extra time each month

If your monthly student loan bill is due within the few days before you get your paycheck, it can feel more difficult to make that payment, since you could already be strapped for cash at that point in your pay cycle. If you have an account with the NSLSC, consider requesting a change of your payment due date through your NSLSC online portal so that you can switch to a date that’s more convenient for your budget.

Consider consolidating your loans

If you have more than one student loan, keeping track of them could be tough. Consolidating multiple student loans into a single consolidated loan may make the repayment process simpler.

Methodology

To determine the average student loan debt among Canadian Credit Karma members, we analyzed, in aggregate, more than 170,000 members who had student loan debt reported on their TransUnion credit reports in Q1 and Q2 of 2019. Among Canadian Credit Karma members with student loans, we analyzed the amount of student loan debt carried by certain age groups as reported on their TransUnion credit reports. We also looked at aggregate postcode data reported on TransUnion credit reports of Canadian Credit Karma members with student loan debt to develop a list of provinces/territories and metro areas where members held the most student loan debt on average.