When asked to rank their biggest fears in a recent Credit Karma survey, Canadians said personal debt and death were at the top of their list.

Why this existential dread around personal debt? According to our survey, it may be because Canadian respondents are worried about how debt could affect their long-term capability to save or ability to pay off surprise expenses.

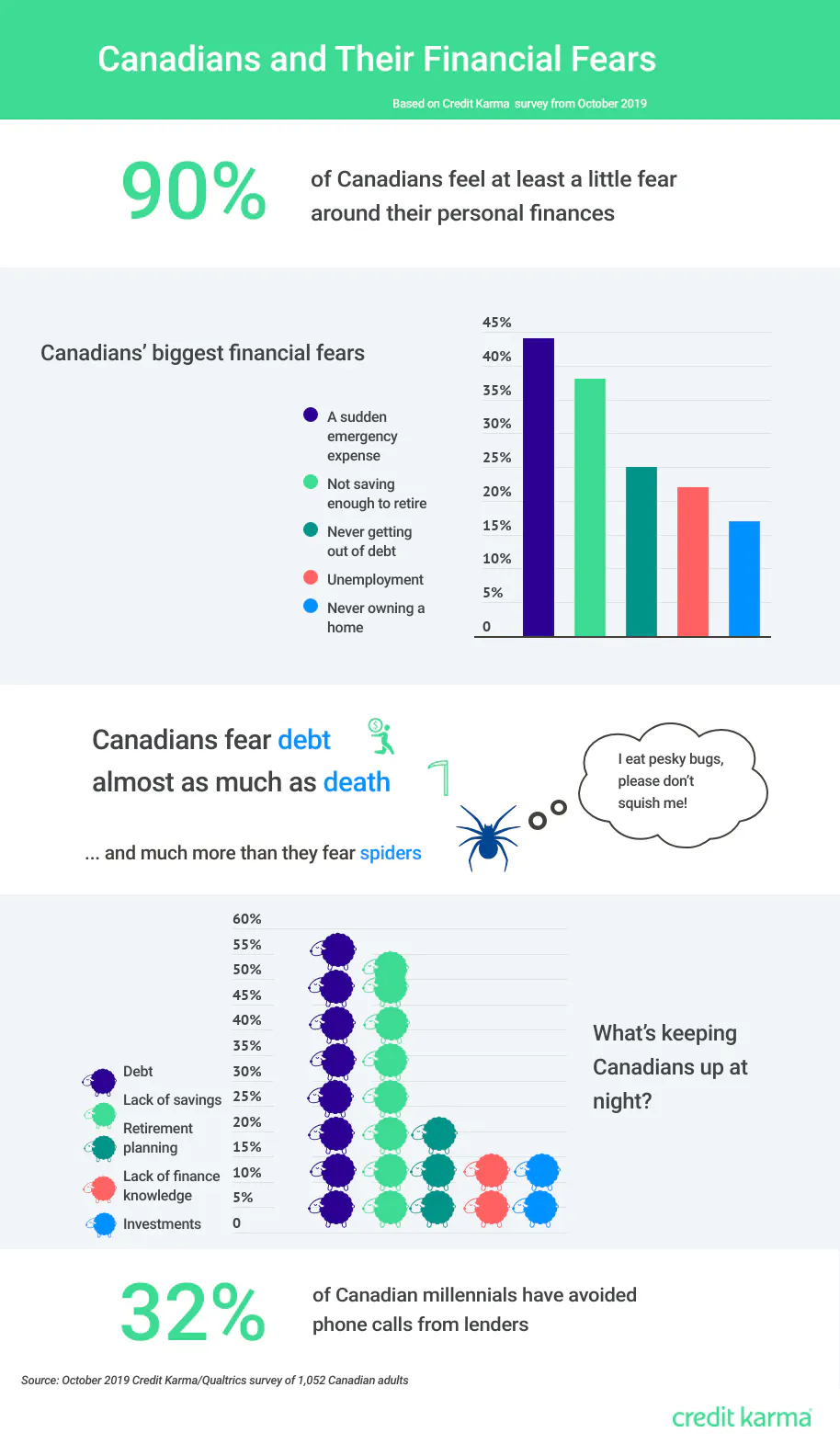

When asked about their top financial fears, Canadians in our survey said having an unexpected expense, not saving enough to retire, and never being able to get out of debt brought them the most fear. (Learn about our methodology.)

Though Canadians’ financial fears can run high, there’s good news — you can work to overcome your financial fears with a little planning and strategy. We’ve got some tips below.

Key survey findings

| When asked to rank their biggest fears, Canadians in our survey ranked death and personal debt, respectively, as their top fears. |

| When it comes to financial fears in general, Canadian respondents said they are most afraid of incurring a sudden, unexpected expense (44%) and not having enough to retire (38%). |

| 43% of Canadians in our survey said they lose sleep over their finances. The top financial concerns keeping these sleepless Canadians up at night are debt (57%), retirement planning (22%) and lack of savings (55%). |

| The older the Canadians in our survey were, the less optimistic they felt about retirement: 26% of Gen Z is worried about not saving enough to retire compared with 36% of millennials and 40% of Gen X and older. |

| Younger generations are becoming more comfortable turning to their peers for financial advice — 41% of Gen Z and millennials said they occasionally or often ask peers for advice on financial issues, compared with just 20% of Gen X and older. |

See our key findings infographic

What do Canadians fear most about finances?

Canadians in our survey have a great fear of personal debt. We asked survey respondents to rank their greatest fears on a scale of 1 (greatest fear) to 5 (lesser fear).

Death ranked highest (2.6) followed closely by debt (2.8). Things Canadians were less afraid of than debt included public speaking (2.9), climate change (3.1) and spiders (3.6).

What are Canadians’ biggest financial fears? Our survey found unexpected expenses are the biggest worry (44%), followed by situations that could cause a change in their financial circumstances — retirement (38%), remaining in debt (25%) or unemployment (22%).

| What are Canadian respondents’ biggest financial fears? | Percentage |

| A sudden, unexpected expense | 44% |

| I won’t save enough to retire | 38% |

| I’ll never get out of debt | 25% |

| Unemployment | 22% |

| I’ll never own a home | 17% |

In addition to causing stress, financial worries lead 43% of Canadians to lose sleep. The top reasons Canadians lose sleep over finances are debt (57%), retirement planning (22%) and a lack of savings (55%).

Financial fears vary by age

Almost all Canadians in our survey have some financial fears — 94% of Gen Z, 93% of millennials and 89% of Gen X (and older) said they are at least a little worried about their personal finances.

However, financial fears of survey respondents vary depending on age. Here’s what we found when looking at Canadian respondents’ top financial fears by generation:

| What are Canadian respondents’ biggest financial fears? | Gen Z | Millennials | Gen X+ |

| A sudden, unexpected expense | 35% | 36% | 49% |

| I won’t save enough to retire | 26% | 36% | 40% |

| I’ll never get out of debt | 27% | 31% | 23% |

| Unemployment | 32% | 27% | 18% |

| I’ll never own a home | 31% | 23% | 12% |

A recent Credit Karma survey of U.S. millennials found that many experience the “money scaries” — that is, they feel too burned out to deal with their finances. Our survey on Canadians’ financial fears suggests millennials north of the U.S. border struggle too.

Nearly one-third (32%) of Canadian millennials in our survey with at least occasional financial fears have avoided calls from a lender, and almost as many (30%) have avoided looking at their credit card statement.

Survey respondents’ attitudes toward retirement vary by age too, and Canadians tend to be more optimistic about their ability to save enough for retirement the younger they are. Over one-quarter of Canadian Gen Zers (26%) in our survey were worried about not having enough saved to retire, compared with 36% of millennials and 40% of Gen X and older.

Conversations about money are becoming less taboo

Despite the high percentage of survey respondents worried about their finances, we found there may be some good news for the future. The way Canadians talk about money is changing. Younger generations are becoming more comfortable turning to their peers for financial advice.

In fact, according to our survey, 41% of Gen Z and millennials said they occasionally ask peers for advice on financial issues, compared with just 20% of Gen X and older.

This comfort that younger Canadians have about financial conversations may have two causes, our survey indicated. For one thing, Gen X (and those older than Gen X) are much more likely to view finances as a private matter (50%) than millennials (37%) and Gen Z (29%). Another potential factor could be that Gen X and older respondents said they feel more confident about their financial knowledge compared with millennials and Gen Z, so they might not feel as if they need to ask for advice as often.

Tips to help you overcome your financial fears

A little planning and strategy can help you overcome your financial fears before they become financial nightmares. See our tips below.

1. Understand your budget

Our survey found 44% of Canadian respondents would rather organise their closet than plan a budget. However, knowing how to make a budget that works for you can be a key way to prepare so you don’t feel so anxious about your finances. The Financial Consumer Agency of Canada has tips on how to make a budget and advice on how to stick with it.

2. Set expectations with friends and family

It might seem awkward at first, but talking with friends and family about expectations for spending could help a lot. After all, you’re not the only one worrying about finances — our survey found 90% of Canadians have at least a little financial fear. So if you get past the initial awkwardness of a conversation about money, you might find that your concerns are similar.

3. Know how your credit’s doing and the ways to keep it healthy

Credit scores can be intimidating — 44% of Canadians we surveyed would rather check their grade after an exam than check their credit scores. Still, it’s important to have an idea of your credit health since having poor credit could increase what you pay to borrow money, leaving you with less money in your pocket. There are many factors that go into improving your credit health like making on-time payments and paying off credit card balances in full and on time.

Methodology

On behalf of Credit Karma, Qualtrics commissioned a nationally representative online survey of 1,052 Canadians ages 18 and over in October 2019 to better understand their fears around finances.