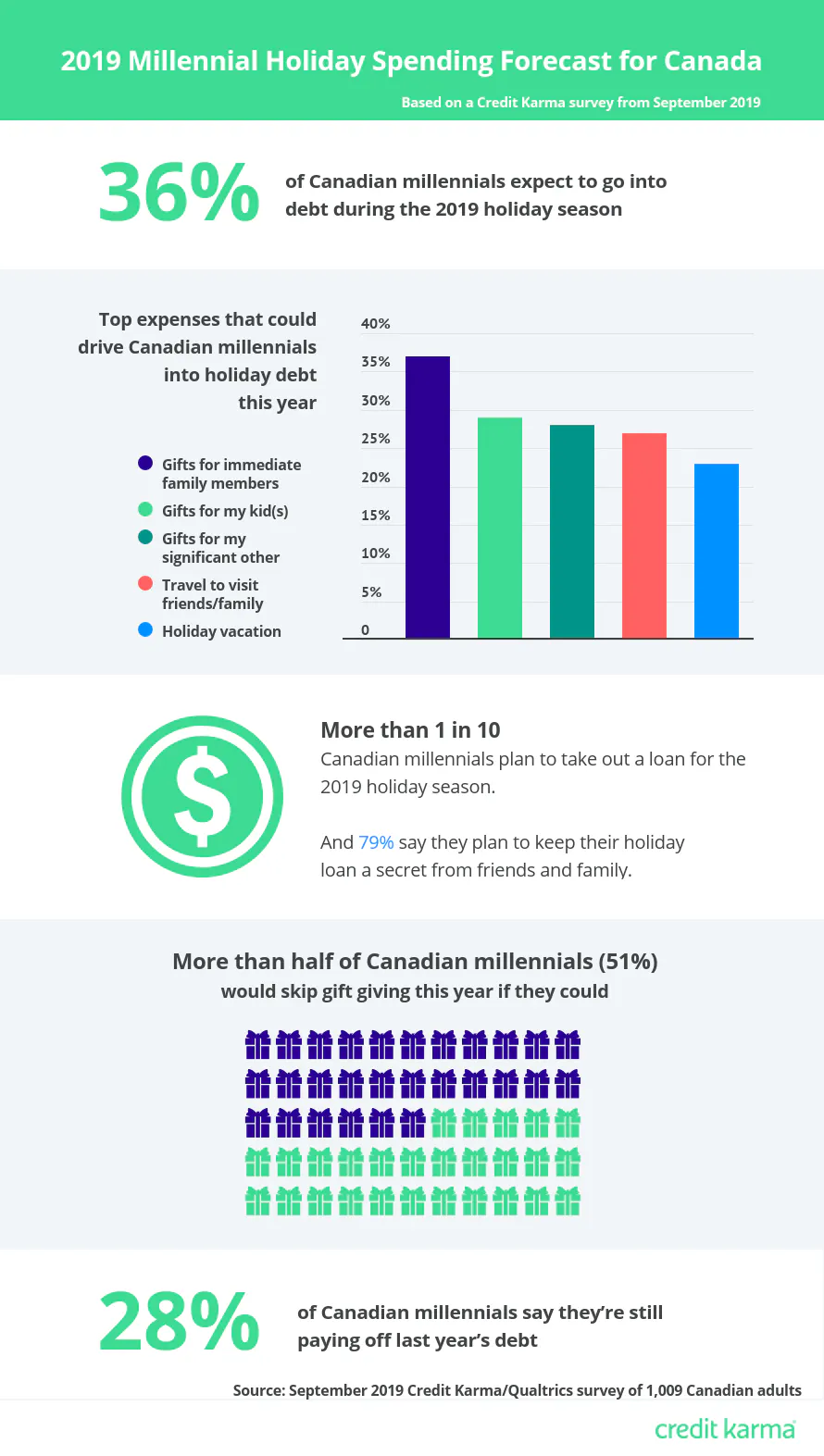

Over a third of Canadian millennials — 36% — expect to go into debt this holiday season, according to a recent Credit Karma survey.

What’s more, of those who went into debt over the holidays last year, 28% are still trying to pay it off. Here are some other key takeaways from our survey looking at holiday spending by Canadian millennials.

- Canadian millennials say gifts for their own kids and spouses will be a top debt driver this holiday season. So will traveling to visit friends and family.

- A healthy share of Canadian millennials (62%) will rack up more than $500 in debt over the holidays this year — most plan to do this with credit cards, but some plan to use personal loans. (Learn about our methodology.)

- Many of Canada’s millennials feel major stress as the holidays approach. For some, that means more arguments about finances with their significant others — or even keeping secrets from loved ones about holiday borrowing and spending.

The good news is you don’t have to be haunted by the ghosts of holiday debt when the new year rolls around. Planning ahead, looking for deals and getting crafty can help keep your life merry and bright even after the holiday buzz wears off.

Key survey findings

| Nearly 2 in 5 (36%) Canadian millennials expect to go into debt this holiday season. Almost 2 in 5 (38%) people in that group expects that debt to total more than $500. |

| Almost half (45%) of Canadian millennials feel debt is unavoidable during the holidays. |

| More than a quarter of Canada’s millennials (28%) who went into debt last year are still paying that debt off almost a year later. |

| Over half (51%) of Canadian millennials said they would skip holiday gift giving if they could. |

| More than 1 in 10 Canadian millennials (14%) plan to take out a loan for the holidays. Of them, 79% plan to keep it a secret from friends and family. |

| Most Canadian millennials who plan to go into holiday debt said they’ll likely go into debt to buy gifts for their immediate family or children (66%). Meanwhile, 27% think they’ll go into debt due to holiday travel and 22% think they’ll go into debt because of holiday meals. |

| Almost half of millennials in Canada (48%) feel immense personal stress leading up to and through the holidays. More than one quarter (27%) would rather pay down existing debt instead of holiday gift giving, while 22% wish they could use gift money to save for a home or car. |

See our key findings infographic

How much debt do Canadian millennials expect to take on this holiday season?

Given the pressure millennials can feel to keep up with their peers, it’s no wonder nearly half of Canada’s millennials from our survey (45%) said they think holiday debt is unavoidable.

But just how much debt are millennials planning to take on this season? Most will pile up a few hundred dollars of debt over the holidays, our survey found — with nearly 2 in 5 (38%) planning to go more than $500 into debt.

| How much holiday debt will you have? | % of Canadian millennials |

|---|---|

| $1–$50 | 2% |

| $51–$100 | 8% |

| $101–$300 | 21% |

| $301–$500 | 31% |

| $501–$1,000 | 26% |

| $1,001–$5,000 | 9% |

| Above $5,000 | 3% |

Of the millennials who went into holiday debt last year, 76% said they used credit cards to do so. But we also found holiday loans might become increasingly common among Canada’s millennials, with more than 1 in 10 millennials (14%) planning to take out a loan this holiday season.

What holiday expenses are likely to drive Canada’s millennials into debt this year?

There are a number of purchases that people think they’ll make this holiday season that will lead to debt, and not all of them are related to gifts. Here’s what we found.

| What will make you go into debt this holiday season? | Percentage of millennial respondents |

|---|---|

| Gifts for immediate family members | 37% |

| Gifts for my kid(s) | 29% |

| Gifts for my significant other | 28% |

| Travel to visit friends/family | 27% |

| Holiday vacations | 23% |

Why are so many millennials taking on debt for these items and experiences? Data on millennials’ holiday spending last year could help shed some light on this.

Most (39%) said they went into holiday debt last year because they simply didn’t have enough money to begin with.

At the same time, social and family pressures are also a factor: A little over a quarter (26%) of millennial respondents said their spending is motivated by a desire to give their kids a better holiday experience than they had as kids themselves. Some 23% said they promised loved ones gifts that were over budget.

The impacts of holiday debt

Nearly half (48%) of Canadian millennials from our survey said they feel a lot of personal stress leading up to the holidays. And there are consequences for people’s relationships and finances.

For instance, our survey found that among millennials who plan to take out a loan to finance the holidays this year, 79% plan to keep the debt a secret from friends and family. And more than 1 in 5 millennials (21%) admit they argue more with their partner about finances during the holidays.

In addition, holiday spending can have a long-term financial impact as people struggle to pay off debt. We found that more than a quarter (28%) of millennials who went into debt last year are still paying off that debt nearly a year later.

And all in all, more than half of millennials (51%) would choose to forego spending on holiday gifts if they could.

So what would millennials rather be spending money on? More than a quarter (27%) of millennial respondents said they’d use it to pay off existing debts, 22% would use it to save up for a home or car, and 21% would put it towards travel.

Tips to help you manage holiday spending

When it comes to the holidays, there can be a lot of demands on your time and money. But with a little planning and strategy, you can enjoy the fun of gift-giving and spending time with friends and family without the burden of debt.

And you’ll be in good company — 49% of millennials we surveyed plan to make changes to their spending to lower expenses this holiday season.

1. Set expectations with friends and family

It might seem awkward at first, but talking with friends and family about expectations for spending during the holidays can help a lot. We found just about a third (33%) of millennials who plan to save money this holiday season will agree upon a set budget with those they’ll exchange gifts with.

2. Look for deals year-round

The holidays happen around the same time each year, which can be really helpful when it comes to planning. Nearly a third (31%) of Canadian millennials who plan to save money this year plan to do it by shopping for holiday gifts year-round.

If you see something on sale in July and know you can gift it to someone in December, go for it. You won’t have to compete with crowds and you may even be able to get it for a bargain if you buy it during special times of year, like Canada Day, or special sales events.

Other ways millennials plan to save this year that could work for you include using coupons (40%), making sure you get price matching on purchases (37%), or shopping at outlet stores (31%).

3. Get crafty

Think about who on your list might appreciate something unique — a handmade hat, for example, or a preloved book. More than a quarter (26%) of millennials who want to save this holiday season plan to give homemade gifts to loved ones, while 17% plan to buy used or consignment items, and 13% plan to re-gift.

4. Avoid temptation

It’s easy to feel FOMO around the holidays. In particular, advertising may lead to some impulse buys. In fact, more than a quarter or millennial respondents (27%) said they’d probably buy an item during the holidays after seeing an ad for it on social media. Consider using an ad blocker online to eliminate temptation.

Methodology

On behalf of Credit Karma, Qualtrics commissioned a nationally representative online survey of 1,009 Canadians ages 18 and over in September 2019 to better understand how they spend during the holidays.