If you’re getting ready to apply for a new credit card, you might be worried about whether you’ll be approved.

Nobody likes feeling rejected, but there’s more to it than that.

Applying for a credit card usually results in the card issuer making a hard inquiry on your credit, which could lower your credit scores by a few points and stay on your credit reports for up to three years.

Of course, you want to be approved when you apply for a card. But what you don’t want is multiple applications resulting in too many hard inquiries clogging up your credit reports. So it’s important to understand your chances of being approved for a particular card before applying. That’s where Credit Karma Approval Odds can help.

What are Credit Karma Approval Odds?

When you’re logged into Credit Karma and searching for a new credit card, you might see notes about your approval odds near a card’s image.

Image: ApprovalOdds_Canada_AllOptions

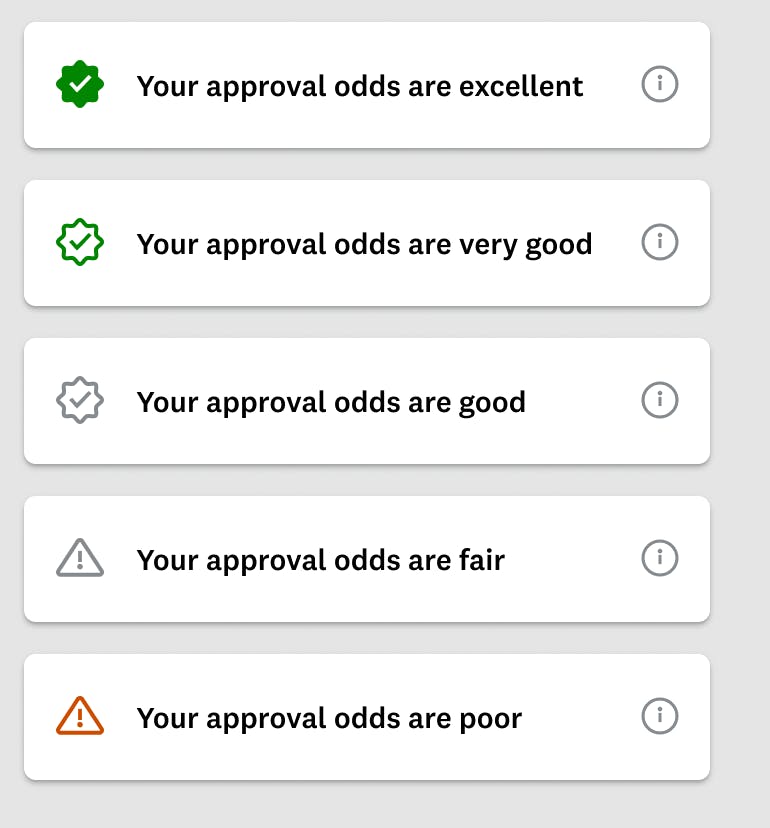

Image: ApprovalOdds_Canada_AllOptionsLike the example shows, Approval Odds can include “Excellent,” “Very Good,” “Good,” “Fair” and “Poor.” But what, exactly, do they mean?

Approval Odds serve as guidelines regarding the likelihood you’ll be approved for a specific credit card. Everyone’s credit situation is different, so your odds might be different from those of other Credit Karma members.

Scroll over the Approval Odds tab, and you’ll see a pop-up message that explains how Credit Karma determines your unique Approval Odds.

“Credit Karma looks at how your credit profile compares to other Credit Karma members who were approved for this product. Of course, there’s no such thing as a sure thing, but knowing whether your Approval Odds are Excellent, Very Good, Good, Fair or Poor may help you narrow down your choices.”

If you’re looking for a new credit card, these Approval Odds can certainly help you when you’re evaluating which one is the best fit for you.

Approval Odds are guidelines — not guarantees

Even if your Approval Odds are “Excellent,” “Good” or “Very Good,” remember that the issuer — not Credit Karma — always has the final say in whether you’ll actually be approved.

Credit Karma compares your credit profile to the credit profiles of other members who were approved for the card to assess the likelihood that you’ll be approved too.

Though this determination is based on member data, it’s not a guarantee that you’ll be approved. Everyone’s credit situation is unique, so there’s simply no way to make a perfect comparison between our members’ profiles.

Some things a bank may take into account when deciding whether to approve your application include …

- Your percentage of on-time payments

- Credit card utilization

- Derogatory marks

- Average age of your open credit accounts

- Your total number of accounts

- Total hard credit inquiries

- Number of 30-day delinquencies

Because there are many factors involved, it’s not uncommon for a person to have “Very Good” Approval Odds and ultimately get denied.

We know it can be frustrating to get denied for a card after having “Good” Approval Odds on Credit Karma. You might think even it’s misleading or just plain wrong. That’s totally understandable — but you should know there’s more to it.

“While having this context can be extremely helpful to users, it’s not always 100% accurate because it’s an estimate, based on Credit Karma’s analysis, rather than coming directly from the credit card company,” says Roger Ma, CFP® and founder of LifeLaidOut.com.

Why ‘Excellent,’ ‘Good’ or ‘Very Good’ Approval Odds don’t guarantee approval

Credit Karma is all about empowering people with accurate, transparent information — it’s baked into our mission.

Though Approval Odds use statistical analysis to determine the likelihood of approval, it’s important to understand some of the other factors at play.

First, there are several different credit score models out there. Credit Karma doesn’t actually calculate your credit scores — the scores and credit reports on our site come from TransUnion, one of the major consumer credit bureaus.

Credit Karma provides CreditVision Risk Score calculated directly by TransUnion. But a credit card company will likely use a different scoring model altogether.

There can be variation among credit scoring models and even among credit bureaus. Many different factors could be considered when calculating a score, and each model may weigh credit factors differently.

But though your scores may vary, they’re all based on information in your credit reports. So focusing on what’s in your reports can help you build better credit overall. These scores can help you figure out where you stand, but it’s ultimately the credit card company that will look at all your risk factors and determine if you’re a qualified candidate for its product.

What to do if you aren’t approved

If your application for a new credit card gets denied, don’t panic. Though the hard inquiry necessary for the application may affect your credit scores, getting denied doesn’t further hurt them. The impact on your credit may be small and can improve over time.

Secondly, check your credit reports to make sure all the information is correct. If not, you’ll want to dispute any errors.

On top of that, make sure your credit utilization — the amount of available credit you use — is below 35%. You’ll also want to verify your payments are on-time and paid in full to keep your credit in good shape.

If you really think the credit card company made a mistake in rejecting you, consider calling the company’s reconsideration line to make your case. There’s no guarantee this will work, but it can’t hurt to try.

Bottom line

While by no means the final say, Credit Karma Approval Odds should be used as a guideline for the types of credit cards that may be a good fit for you.

Ultimately, your best bet is to take care of your credit by making on-time payments and keeping your balances low. Building your credit is one of the best ways to increase the approval odds in your favor.